are hoa fees tax deductible on a second home

Are Hoa Fees Tax Deductible On A Second Home The association that imposes charges and analyses is an exclusive agency and also the expenses are simply among the many homeowner expenditures you can not cross out. Every homeowners association HOA is different but there are several situations in which you can deduct some or all of your HOA fees.

Second Home Tax Tips What Most People Don T Realize

Though the HOA dues may feel like a tax HOA fees are paid to your homeowners association rather than to a state or local government so you cant include them as a tax deduction.

. A Homeowners Association HOA is a governing body that sets specific rules and guidelines that you agree to abide by when you purchase property in a condominium gated community apartment or other type of planned development. Unfortunately HOA fees are not deductible as sales expenses. The IRS considers HOA fees as a rental expense which means you can write them off from your taxes.

If your second property is considered a personal residence you can deduct mortgage interest in the same way as you would on your primary home. There are many costs with homeownership that are tax-deductible such as your mortgage interest and property taxes however the IRS will not permit you to deduct HOA fees they are considered a charge by a private individual. Are HOA fees deductible on a second home.

HOA fees paid at home purchase can be added to the basis of a home. However if the home is a rental property HOA fees do become deductible. Previously you could borrow against home equity and take a deduction on the interest regardless of whether the proceeds were used to pay off a credit card take a vacation or bu.

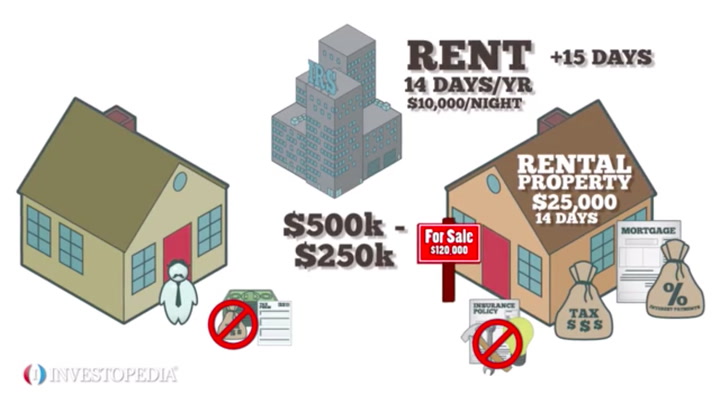

Please know that to qualify for tax deductions of any type on rental property your property has to be rented out at least 15 days per year. Taxes on a second home are deductible but. Mortgage Interest DeductionPersonal Residence.

In this case the IRS considers HOA fees to be a deductible cost of maintaining the rental property You report the fees on Schedule E on your tax return. Taxes on a second home are deductible but homeowner association fees arent a tax. Yes you can deduct your hoa fees from your taxes if you use your home as a rental property.

HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas. If the home is a rental property however HOA fees do become deductible. Homeowners association fees are tax deductible only if it is an investment property.

If youre planning to set up a home office and use the space solely for business purposes you may be able to deduct a portion of the fee. For instance if your workspace takes up 5 of the total space in your townhome you can deduct 5 of. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property.

You cant deduct HOA fees for your primary residence although you may deduct a percentage if you use the property as a business. This goes for your primary residence and your second home too if no one uses. You can deduct property taxes on your second home too.

The IRS considers HOA fees as a rental expense which means you can write them off from your taxes. Are HOA-fees deductible. Are HOA fees deductible on a second home.

Yes HOA fees are deductible on a home you dont live in that you use as a rental property. The taxes due in 2020 for 2019 were 1375. Instead you add the 1375 to the cost basis of your home.

Filing your taxes can be financially stressful. Additionally if you use the home as your personal residence your HOA fee wont be tax deductible in that case either unless you run a business out of that home. However there are special cases as you now know.

If you only use your second home for personal use youre not allowed to claim a tax deduction for HOA fees. The association that imposes fees and assessments is a private agency and the costs are just one of the many homeowner expenses you cant write off. Taxes on a second home are deductible but homeowner association fees arent a tax.

Heres more info on that. The association that imposes fees and assessments is a private agency and the costs are just one of the many homeowner expenses you cant write off. In fact unlike the mortgage interest rule you can deduct property taxes paid on any number of homes you own.

If the townhouse is your primary residence your HOA fees are not tax deductiblewith one exception. Are Homeowners Association Fees Tax Deductible. For the most part no but there are exceptions.

Generally if you are a first time homebuyer your HOA fees will almost never be tax deductible. As a general rule no fees are not tax-deductible. First though lets take a look at what an HOA is what they offer and what that can mean for you come April 15.

Therefore if you use the home exclusively as a rental property you can deduct 100 percent of your HOA fees. Heres more info on that. This goes for your primary residence and your second home too if no one uses those homes but you and your.

Taxes on a second home are deductible but homeowner association fees arent a tax. Many homes are subject to homeowners association fees. However beginning in 2018 the total of all state and local taxes deducted including property taxes is limited to 10000 per tax return.

If your property is a second home or vacation home that you use personally but also rent out things get a bit more complicated. The association that imposes fees and assessments is a private agency and. You cant deduct any of the taxes paid in 2020 because they relate to the 2019 property tax year and you didnt own the home until 2020.

Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. The taxes due in 2021 for 2020 will be 1425. Yes hoa fees are deductible on a home you dont live in that you use as a rental property.

However there are other home deductions still available under the new tax law. As a homeowner it is part of your responsibility to know when your HOA fees are tax-deductible and when they are not. These fees pay for the shared amenities in a housing development or condominium property.

Are HOA fees tax deductible. If the second home is a vacation property where you reside in it some of the time youll have to determine what percentage of time you are using the home as a rental property and claim the HOA fees based on the period you collected rent.

Guide To Buying A Second Home In Nyc Hauseit New York City

Considering A Second Home On Oahu

/cabin-5bfc37f1c9e77c0051831f7e.jpg)

Top Tax Deductions For Second Home Owners

Buying A Second Home Tax Tips For Homeowners Turbotax Tax Tips Videos

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

7 Benefits To Owning A Second Home Buying A Home Annie Markuson

7 Benefits To Owning A Second Home Buying A Home Annie Markuson

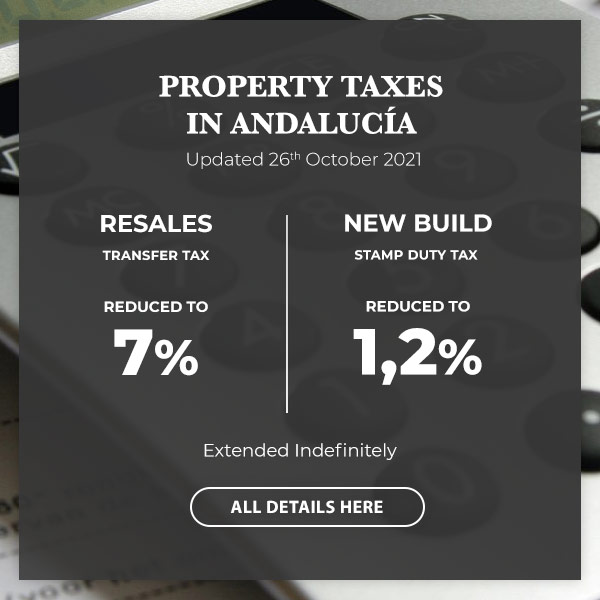

The Cost Of Buying Owning And Selling A Property In Spain The 12 Main Property Taxes In The Country One Off And Annual Fees

Home Sweet Second Home Vacation Investment Luxury Properties Ppt Download

Considering A Second Home On Oahu

The Cost Of Buying Owning And Selling A Property In Spain The 12 Main Property Taxes In The Country One Off And Annual Fees

Your House Closing Timeline A Step By Step Guide Real Estate Buying Homebuyer Guide Home Buying

Top Tax Deductions For Second Home Owners

Property Buying Costs In Spain General Guide And Useful Calculations

Second Home Tax Benefits You Should Know Pacaso

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Vacation Home Become A Tax Savvy 2nd Home Owner

The Cost Of Buying Owning And Selling A Property In Spain The 12 Main Property Taxes In The Country One Off And Annual Fees

Home Sweet Second Home Vacation Investment Luxury Properties Ppt Download